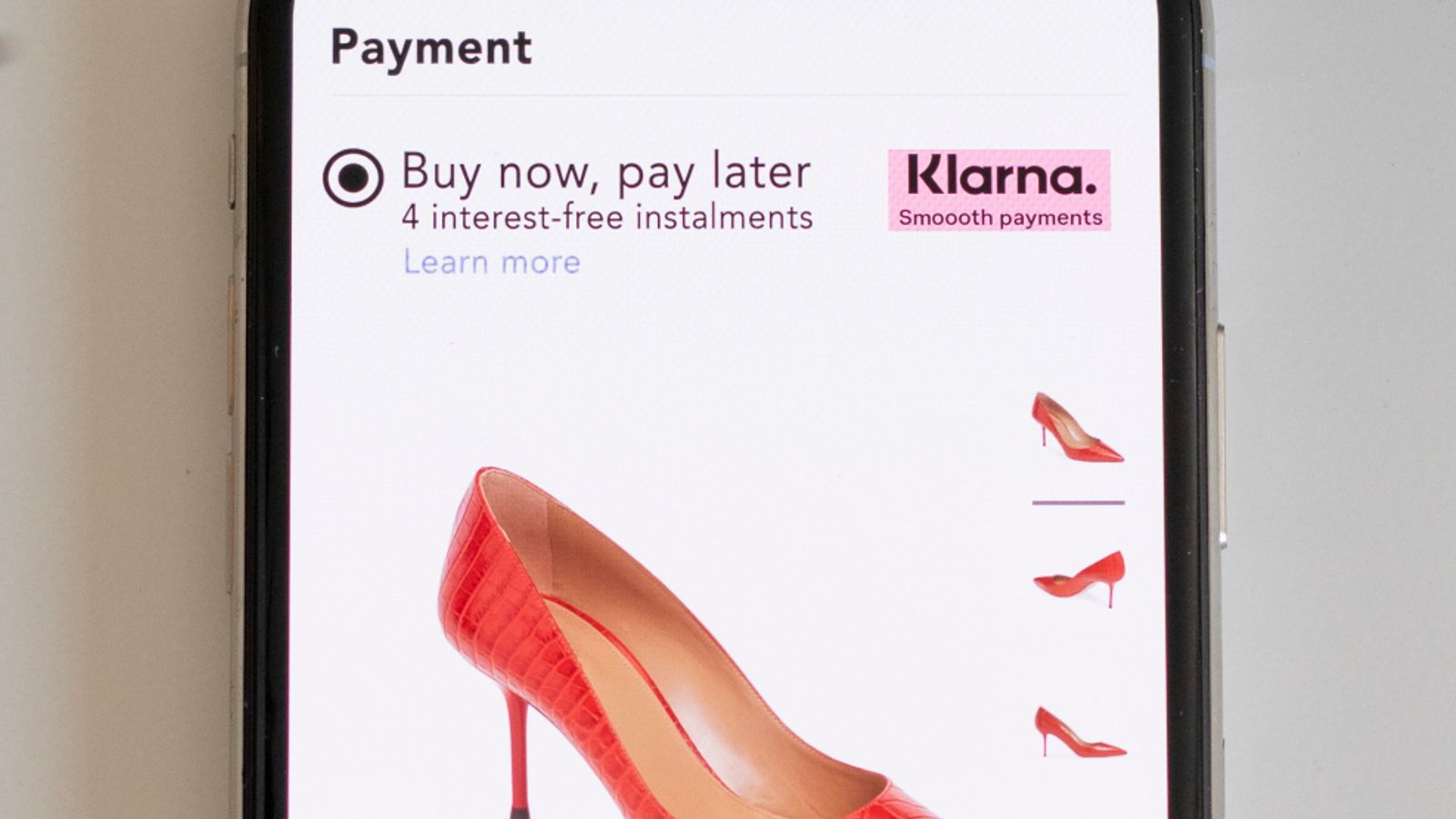

Interest-free “buy-now-pay-later” (BNPL) deals face tighter regulation under plans announced by the government.

A review published by the Financial Conduct Authority (FCA) found that the currently unregulated use of BNPL products nearly quadrupled to £2.7bn during 2020 and five million people had used them since the start of the pandemic.

It concluded that the market should be brought under regulation “as a matter of urgency” as there was “significant potential for consumer harm”.

The Treasury said interest-free BNPL agreements will now be regulated by the FCA.

This article was originally published by Sky.com. Read the original article here.