Liz Truss will warn of a “global battle between free societies and dictatorships” in a speech in the US designed to revive her economic and political agenda.

The former prime minister is due to make a speech in which she will question whether Western democracies – including the UK – are currently “match fit to take on China” and the “whole concept of state capitalism”.

Ms Truss, who currently sits on the Conservative backbenches following a short-lived period as prime minister, will criticise Western governments for “appeasing” autocratic regimes in China and Russia and will argue that more needs to be done to protect Taiwan from Chinese aggression.

She is expected to make the comments at the Margaret Thatcher Freedom Lecture at the Heritage Foundation thinktank in Washington DC on Wednesday.

Ms Truss has kept a relatively low profile since she was ousted as Tory leader after just 44 days in office following Kwasi Kwarteng’s disastrous mini-budget, which spooked the markets and led to an increase in some mortgage rates.

But in recent months she has sought to defend the central plan of her leadership bid – economic growth and low taxes.

Her speech comes on the same day Bank of England governor Andrew Bailey is due to address the International Monetary Fund (IMF) in the US capital.

The IMF struck a decidedly gloomy tone with its most recent assessment of the global economy on Tuesday, warning that it was entering a “perilous phase” of low economic growth and high financial risk.

Read more:

Man denies sending offensive email to Labour deputy leader

Tory MP confirms he will not seek re-election

The fund downgraded its outlook for global growth and said its medium-term forecast for economic output was now at its weakest level since it began publishing forecasts in 1990.

In her speech, Ms Truss is expected to say that her preferred model of “low taxes, limited government and private enterprise” have been overtaken by larger government – which she branded a “disease”.

She will also argue against Organisation for Economic Co-operation and Development (OECD) plans for a minimum 15% corporation tax rate for multinational companies – something she said was “nothing short of a global cartel of complacency”.

She will argue that the “Anglo-American” economic model of individualism is being “strangled into stagnation” by authoritarian regimes and their “unwitting allies in the anti-growth movement”.

“The symptoms are low growth, rising living costs and declining value of wages,” she will say. “The disease is ever larger government. And we have to ask ourselves: are we still match fit to take on China and to take on the whole concept of state capitalism?

“The sad truth is that we have seen stagnation, redistributionism and woke culture taking hold in businesses and the economy in the UK and the US. It results in more tax, more subsidies, more regulation.”

The former prime minister, who was also foreign secretary from 2021 to 2022, will also criticise the West for giving “succour to authoritarian regimes which do not share our values”:

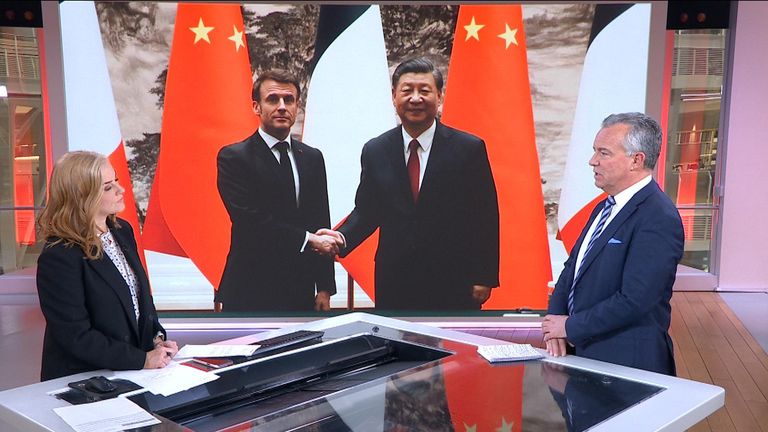

She will single out a decision by French President Emmanuel Macron and EU Commission President Ursula von der Leyen to visit Beijing in an attempt to persuade Xi Jinping to promote an end to the war in Ukraine as an example.

“Putin and Xi have made it clear they are allies against Western capitalism.

“That is why Western leaders visiting President Xi to ask for his support in ending the war is a mistake. And it is a sign of weakness.

“Instead our energies should go into taking more measures to support Taiwan. We need to make sure Taiwan is able to defend itself. We need to put economic pressure on China before it is too late.”