The owner of the Paddy Power and Betfair brands has revealed a £60m hit from a “run of customer-friendly” sports betting results last month, saying it will be partly responsible for a cut to its full-year financial guidance.

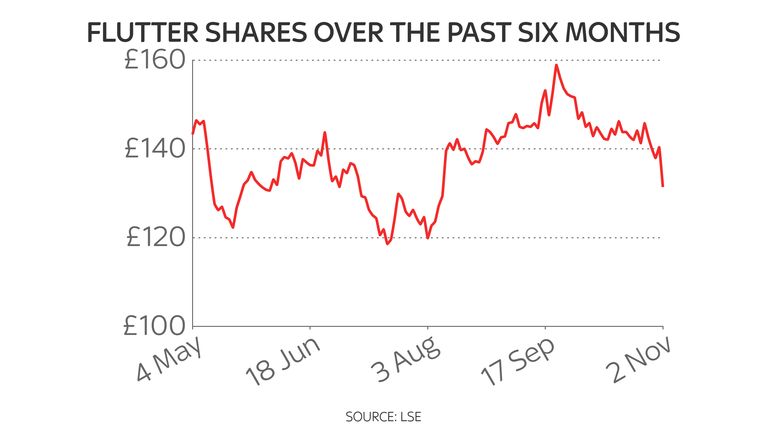

Flutter Entertainment, which is the world’s largest online betting group, saw its shares tumble 7% at Tuesday’s market open after reducing its forecast range for annual adjusted profits to between £1.24bn and £1.28bn.

That compared to the £1.27bn to £1.37bn it had previously expected.

It also blamed a temporary withdrawal from its Dutch online operations, due to a change in regulations, which was tipped to cost it a further £10m this year.

Flutter said its operations outside the United States were hit by “unfavourable sports results in (the) first 24 days of October” but it did not reveal what those events were.

Its third quarter results, covering the three months to the end of October, showed revenue rising by 12% on the same period last year, driven by a 13% hike in average monthly players.

It credited a strong performance in Australia and in the United States in particular where it owns America’s largest betting business, FanDual.

Flutter said FanDuel, which is tipped by financial analysts to be spun off from the parent firm, was now regularly experiencing staking levels on American Football Sundays that match its 2021 SuperBowl performance as gambling continues to takes off rapidly in the US after a ban was lifted on sports betting in 2018.

Revenue in the UK and Ireland fell 5% however, which Flutter said in part reflected a busier, high profile sporting calendar in the prior year.

Chief executive Peter Jackson said: “While a run of customer-friendly results in October have resulted in win margins being below expected levels in the quarter to date, the underlying strength of our business is clear; we have grown our online recreational player base by 46% in just two years.

“With more international jurisdictions and US states on the path to regulation, we look forward to sustainably growing our global player base further in 2022.”

Harry Barnick, senior analyst at Third Bridge, said: “Consolidation is on everyone’s lips following DraftKings’ abandoned takeover of Entain.

“Investors will be wondering what part Flutter could play in the global M&A landscape.

“The US market continues to be a strategic growth area for Flutter with success in this market looking pivotal to the future of the company.

“As regulation opens up on a state-by-state basis, Flutter will be singularly focused on picking up licenses and growing market share in the US.”