A man who famously made a fortune by predicting the collapse of the US housing market in 2008 now appears to be suggesting that two major stock markets will tumble in value.

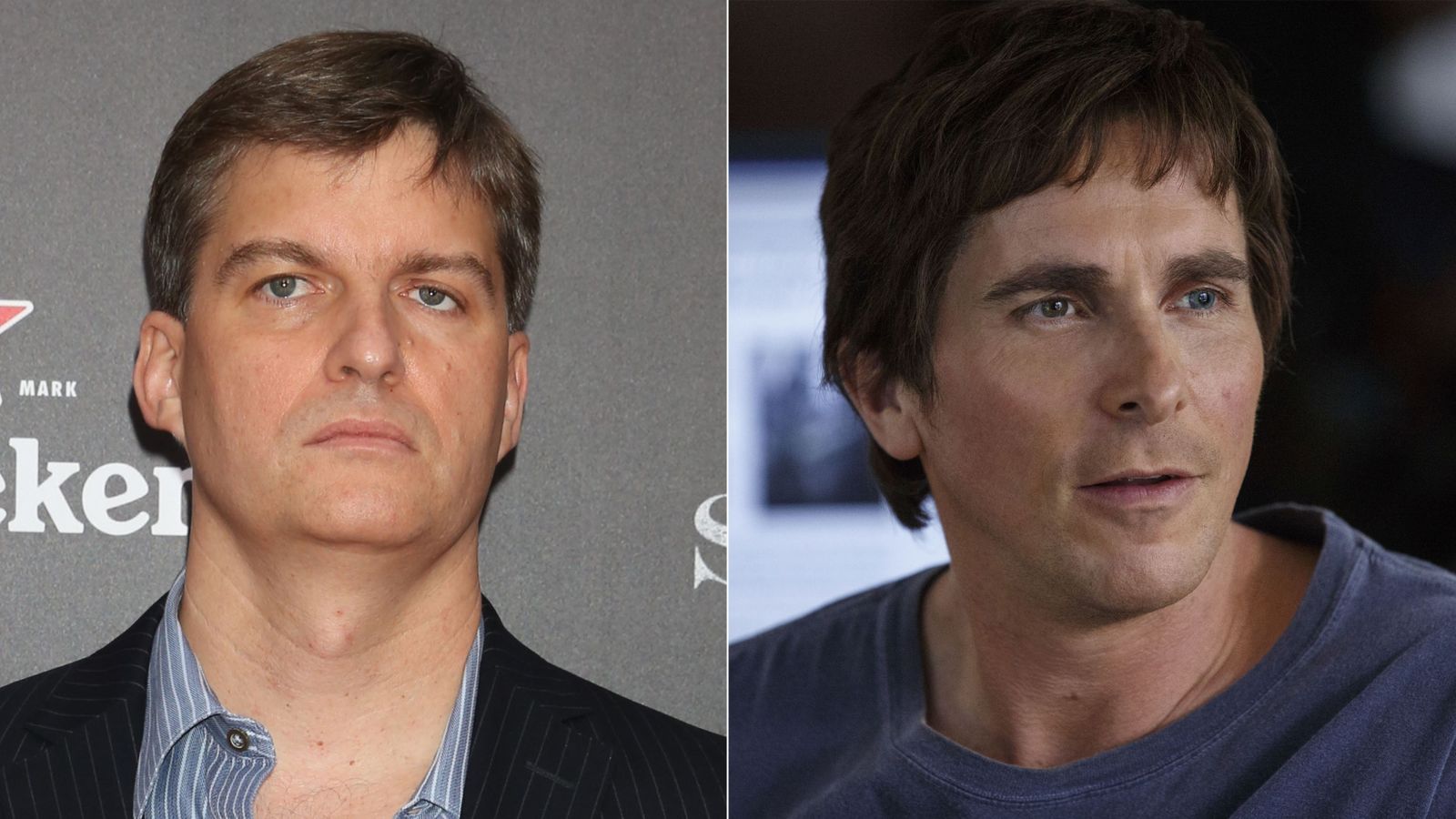

Michael Burry, the hedge fund boss featured in The Big Short, in which he was played by Christian Bale, held negative options on both the S&P 500 and Nasdaq 100 at the end of the second quarter, securities fillings show.

He has options with a notional value of $886m (£698m) against the S&P 500.

In addition, he has $738.8m (£582m) in options against the Invesco QQQ Trust ETF – a fund on the Nasdaq comprising high-profile tech firms including Apple, Microsoft and Tesla.

Mr Burry’s bet on a market downturn amounts to more than 90% of his firm’s portfolio, CNN reports.

It is not immediately clear why he is taking such negative positions – the S&P 500 is up roughly 17% for the year to date, while the Nasdaq 100 is up almost 39% over the same period.

While Mr Burry, who founded Scion Asset Management, appears to have placed a large proportion of his assets at risk, it is not clear what his fund paid for the “put options”.

Such options give the right to sell shares at a fixed price in future, and are typically bought to express a bearish or defensive view.

Mr Burry appears to have been expecting a market collapse for much of the year.

Read more:

Jitters over health of US banks spark global stock market sell-off

Why global investors are looking afresh at the UK stock market

In January, he tweeted: “Sell.”

By March, however, he had backtracked and said he was “wrong to say sell”.

The Big Short – initially a bestselling book published in 2010 – told the story of the people who believed the housing bubble was going to burst – including Mr Burry, who is thought to have made about $100m from the crash.

In addition to Bale, the movie version starred Steve Carell, Ryan Gosling and Brad Pitt.