The chances are you haven’t heard of the BBL pipeline.

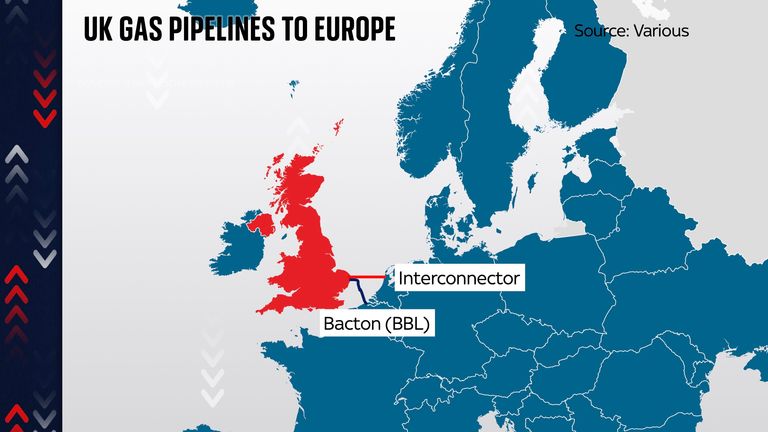

It’s a 235km steel tube which runs under the North Sea between Balgzand in the northern tip of the Netherlands and Bacton in Great Britain.

It’s one of those bits of innocuous infrastructure which, most of the time, no-one except energy analysts pay all that much attention to.

But let’s spend a moment pondering this pipe, because it could prove enormously consequential for all of us in the coming months.

Indeed, BBL has already played a silent but essential role in the Ukraine war and, for that matter, the fate of Europe, because this is one of the two main pipelines transporting gas between the UK and Northern Europe.

Actually, BBL is the smaller of the two pipes, the other of which is the rather unimaginatively-named “Interconnector” pipe. But the reason it’s worth focusing on BBL is because in the past few days something rather interesting happened there.

Before we get to that, though, it’s worth reminding ourselves of the big picture here, the challenge facing Europe: a desperate shortage of energy.

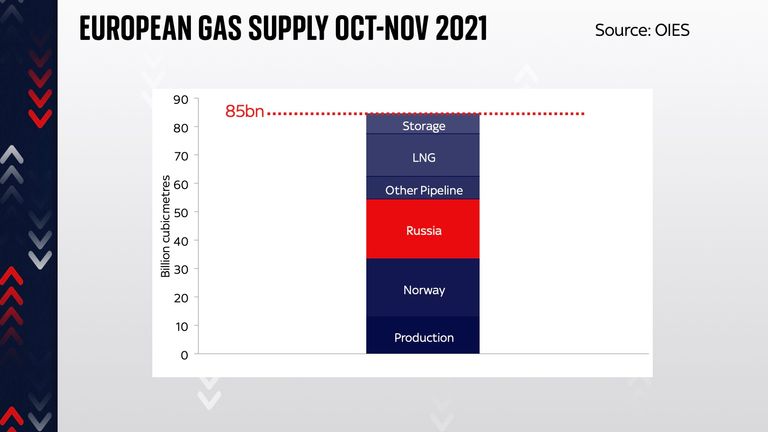

Here’s the best way of understanding it: this time last year, Europe (including the UK) was consuming roughly 85 billion cubic metres of natural gas a month. Of that, about 21 billion cubic metres (bcm) – roughly a quarter – came via Russian pipelines.

That gas didn’t just go into our boilers and gas-fired power stations.

It was a feedstock which helped us manufacture chemicals and fertilisers.

It fed us, it fuelled industry, it helped keep the lights on.

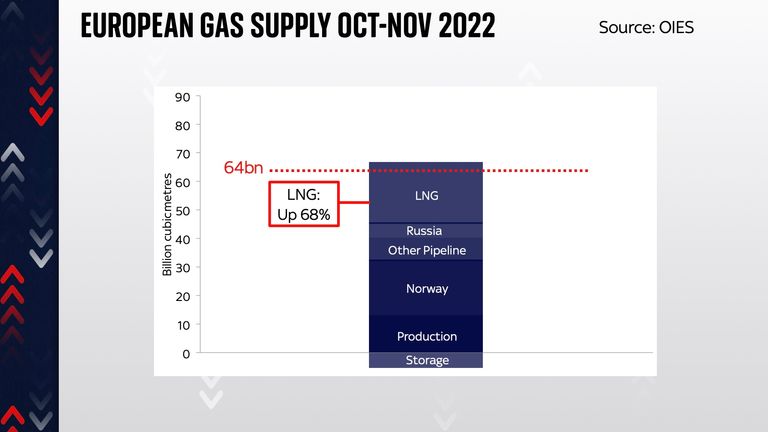

In the wake of the Russian invasion of Ukraine, suddenly Europe couldn’t take that 25% of its energy for granted any more. And indeed, most of the Russian supply has since dwindled (it’s now down 81% to about 4bcm a month).

And so much of what might today be categorised as economic news – the rocketing rate of inflation, the squeeze on household incomes and the recession we’re now sliding into – really comes back to this gap, between the gas we used to consume and the gas we can now lay our hands on.

And the short answer is that getting hold of that extra gas isn’t easy at all.

Partly that’s because most of the non-Russian sources which are already pumping gas into European pipelines (which is to say: mainly Norway but, to a lesser extent, the UK, Netherlands and Algeria) are already producing about all they can.

These days you can ship gas (in the form of Liquefied Natural Gas (LNG), a supercooled liquid) across the ocean from Qatar and the US, but that depends on a few things.

The first is actually getting hold of that gas. The UK on Wednesday published details of a new “US-UK Energy Security and Affordability Partnership” which aims to provide more LNG to the UK. That matters because Britain and Europe are essentially competing with China and other Asian nations on global markets for these cargoes.

The second (and perhaps even more important) factor is having terminals where you can receive and re-gasify the LNG and then feed it into your domestic pipeline network.

But there are only so many of these ports and regasification facilities in Europe. Germany, for instance, has none (though it’s got some temporary capacity coming up soon). The UK has lots. Indeed, it has more LNG capacity in its three ports (two at Milford Haven, one at Isle of Grain) than Belgium and the Netherlands have in total.

The logic of this was that back at the start of the conflict, it looked quite plausible that the UK would become a sort of energy “land bridge” across which gas could be transited to Europe. And that indeed is precisely what happened, which brings us back to the pipeline crossing from the UK to the north of Europe.

Over the past year, a stupendous amount of LNG has been coming into UK ports, drawn in by the stupendously high gas price, from where it has been transferred across the UK’s pipeline network and thence into the European system.

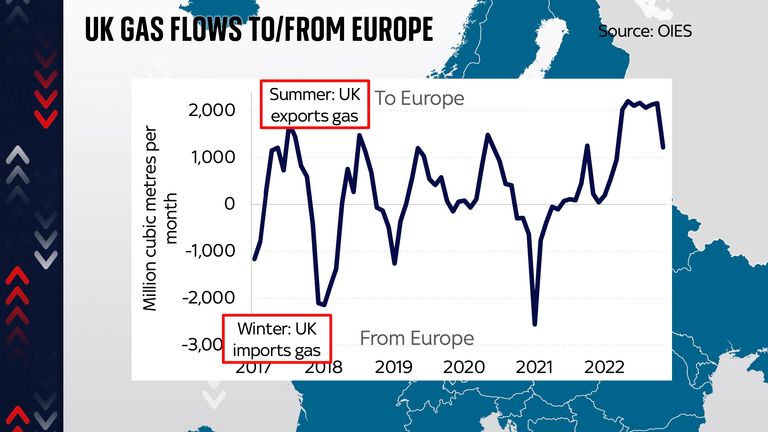

To put this into perspective, in the four summers since 2017, the average amount of natural gas transferred from the UK was around 5.7 trillion cubic metres. This past summer the total was 20.5 trillion cubic metres.

It’s worth dwelling on this for a moment, for it represents one of the under appreciated stories of the Russia-Ukraine war.

Much of the gas which replenished the storage facilities in Europe, which should help them survive the coming winter while keeping homes heated, despite the absence of Russian gas, came via the UK – via the BBL and Interconnector pipelines.

And that’s actually understating it, because those pipelines were only so wide, and so could only carry a certain proportion of the LNG flowing into the UK, but what also happened this summer is that UK gas power plants went into overdrive, burning that gas and turning it into electricity, which was also fed via undersea cables into Europe.

This mattered. Much of France’s nuclear power fleet was out of action this summer as water levels in French rivers ran too low to provide the necessary coolant. British electrons were part of the explanation for why the lights never went out in France.

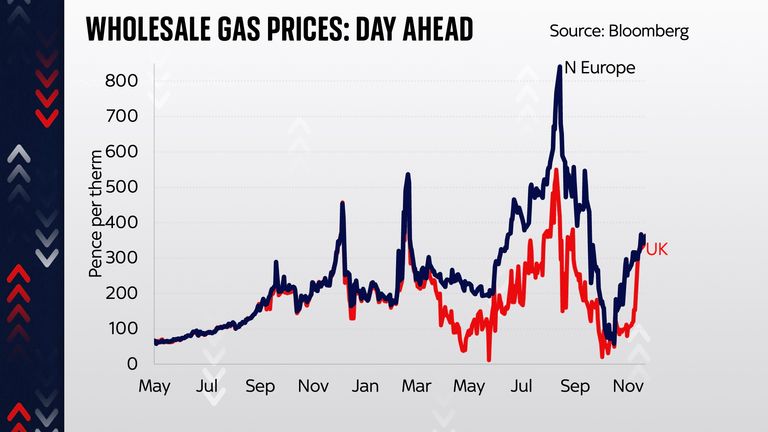

This astounding flow of gas (which of course has its own climactic consequences) caused some interesting price fluctuations this past year. As we reported earlier in the summer, it helped suppress UK day-ahead gas prices down to surprisingly low levels.

For a period in May and June, the UK wholesale gas price was less than half the level in continental Europe – because the UK was awash with all these natural gas molecules trying to fit themselves into these steel pipes coming out of Bacton.

But in recent weeks those flows have begun to drop, which brings us to the interesting thing that changed in the past few days.

For the first time since the Russian invasion of Ukraine and the extraordinary rollercoaster in the gas market, a small quantity of natural gas begun to flow back into the UK.

It’s important not to overstate this. The numbers are very small indeed. But it’s a reminder that actually, in “normal” times, these pipelines serve a very different purpose from the one they’ve served in recent months.

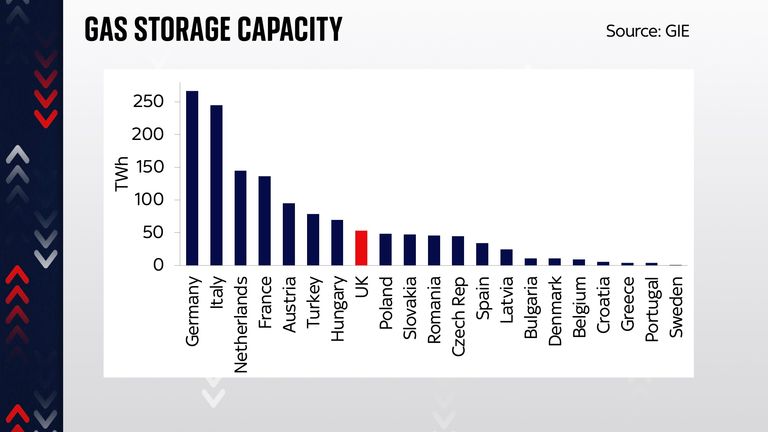

Britain doesn’t have much domestic storage for natural gas. While Germany has about 266 terawatt-hours of storage capacity, the UK has only 53, barely enough to keep boilers going for more than a week or two.

However, the UK strategy in recent years has been to use Europe as a kind of storage system. Think of these underground caverns as a kind of bank.

You deposit gas in them in the warm months and take it out when it gets cold. And in “normal” times the UK has “deposited” its gas in Europe in the summer, sending much of the stuff that came out of the North Sea (and some stuff from those LNG terminals) across the two pipelines and those molecules went into European storage.

And in winter, the UK would typically “withdraw” the gas from Europe when it got cold and it needed a little more for peoples’ boilers. Into Europe in the summer; out of Europe in the winter.

But that brings us to this winter. The UK has put an extraordinary amount of gas into European storage in the summer. What happens if it gets really cold? In any normal winter, it would need to get that gas out of Europe via those pipelines. But this, of course, is not a normal winter. There is a chance that the remaining flows of gas from Russia dry up further, meaning there could be a real shortage. In such circumstances, what happens?

If the market carries on working, then that would push up prices high on continental Europe, but the logic is that in order to attract that gas across the channel, the UK would have to pay even higher prices than continental Europe. In other words, while prices in the UK have been lower than Europe for most of the summer, they could well be higher than Europe for most of the winter.

There is a sign that this is already happening.

In the past couple of days, those prices have converged. But there is also a scarier question: what if the market doesn’t function, because of political interference? What if European nations decide that storage in, say Germany (or for that matter the European Union) cannot leave? Where does that leave the UK, which tends to rely on those pipeline flows from Europe in the event of a cold snap.

The short answer is that no-one really knows. What we do know is that this story isn’t over yet. Gas prices are already eye-wateringly high, especially when you consider that the Government is effectively subsidising them. It’s not implausible that they get even higher.