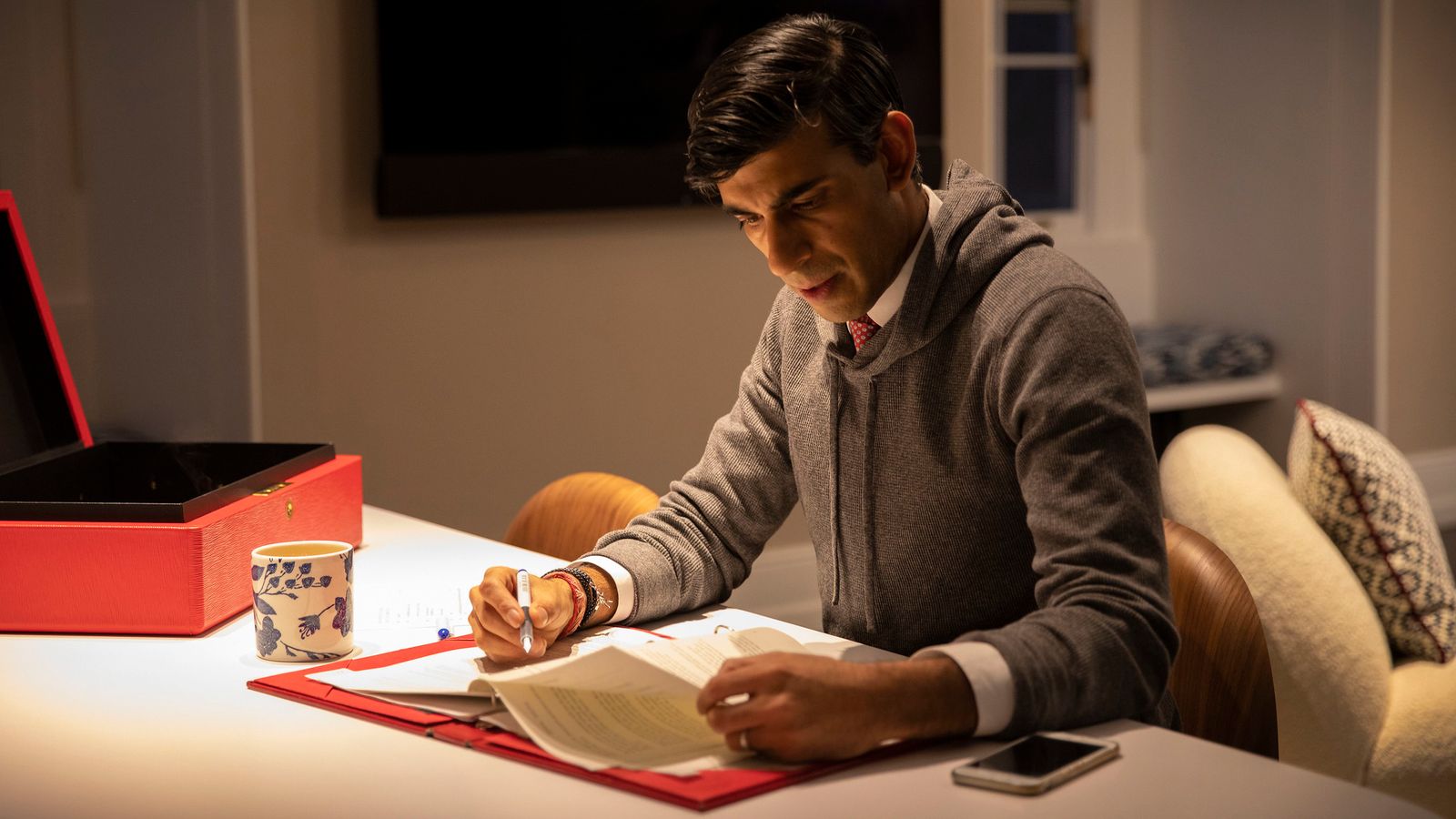

Rishi Sunak has for months been handing out billions and billions of public money.

Be it via the furlough scheme, track and trace, VAT cuts or business support, No 11 has borrowed more during this Covid-19 crisis than anytime since the Second World War to just to keep the economy on ice.

On Wednesday, for the first time, the chancellor will reveal the extent to which this disease has ravaged our public finances and our economy, with the first forecasts since March on debt, unemployment, borrowing and growth.

Brace yourselves because it’s going to be brutal.

“We’re going to find out the public finances have been hit fantastically badly through this process,” says Paul Johnson of the Institute of Fiscal Studies.

Mr Johnson says the economy is probably going to be 10% smaller than it was a year ago – the worst annual contraction for three centuries – and is unlikely to get back to where it was supposed to be at the end of the forecast period in four years’ time.

Borrowing is colossal – at least £370bn, the highest it’s ever been outside the two world wars. National debt levels might reach 105% of GDP.

At some point down the road the chancellor will have to do something about it, but the day of reckoning is still some way off.

In this scaled back Spending Review – covering departmental budgets for just one year instead of the typical three – the chancellor will still be spending.

There’ll be no return to austerity or spending cuts, with departments expecting increases in this one-year spending round.

The chancellor will also make it clear that there’ll be no tax raising until the UK moves out of recession.

He’ll also lay out some capital spending plans for the next three years as he tries to stimulate the economy and create jobs, with projects such as the dualling of the A66 between Middlesbrough and Workington or new bridges in Suffolk and Norfolk likely to be funded.

But he’s also expected not to duck the matter of repairing the public finances in the long-term either.

There will be some who want the chancellor to consolidate now and others who won’t want him to do it at all – happy to kick tax rises out past the next general election.

Mr Sunak is a chancellor who believes that we must put this debt mountain onto a more sustainable path.

It doesn’t have to be done quickly, but the chancellor does believe that tax rises will have to come in this parliament.

And in this view, the chancellor is in lockstep with many economists, including Mr Johnson, who believe the chancellor will have to move to get the deficit “at least to a level where the national debt is no longer on an upward trajectory”.

“That will probably require not this year and not next some tax rises in the early, middle years of this decade.”

And this is the dilemma of Mr Johnson’s Conservatives.

There are many who want low taxes and believe the country can live with huge debt levels in an era of low interest rates.

There are others – and the chancellor is in this camp – who believe in fiscal responsibility and beginning to get this debt under control, with all the torturous political choices that entails as the government starts taxing their Tory shires to pay for the levelling up in the Blue Wall and more.