Short sellers betting against European travel, leisure and bank stocks lost more than $500m (£390m) in Monday’s market rally, according to a data provider.

Shares soared globally when drug company Pfizer announced that early data from phase three trials showed its vaccine was more than 90% effective against COVID-19 – raising hopes economic damage inflicted by the virus could be limited in future.

Market data specialist Ortex Analytics estimated short sellers – typically hedge funds – had made $1.9bn (£1.4bn) from bank shorts alone since March to 6 November.

Short selling is essentially a bet.

Such investors borrow shares and immediately sell them, betting the price will drop before they buy back the shares and return them, pocketing the difference.

But Monday’s trading session proved most lucrative for stocks worst hit by the crisis to date.

Ortex said short sellers of European travel and leisure companies lost $284m (£214m) based on positions held at that time.

Losses for European bank short-sellers totalled $233m (£176m).

The company believed short-sellers’ books were likely further in the red for the week on Tuesday after stock markets extended their gains.

Across Europe, travel and leisure stocks are up 12% collectively since the start of the month while banks have achieved a five-month high as of Tuesday evening.

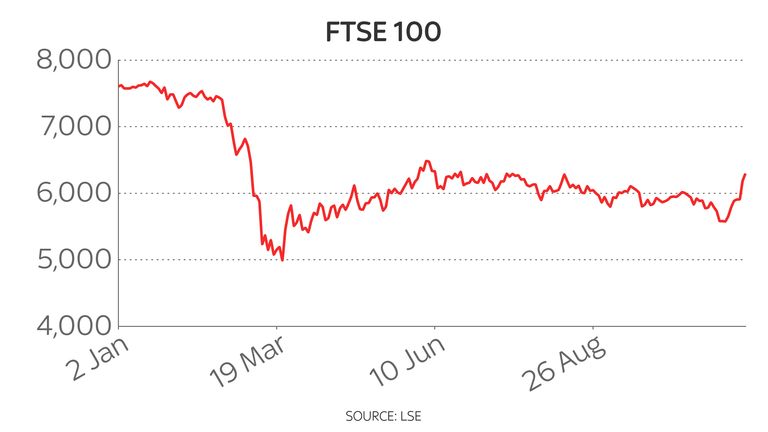

The latest trading session saw the FTSE 100 put on a further 1.8% to close at 6,296. It was a similar performance for other major indices across Europe as the relief rally clung on to some of Monday’s momentum.

Rolls-Royce, Carnival and British Airways owner IAG have been among the biggest winners in terms of percentage gains this week.

Ortex co-founder Peter Hillerberg said: “Whilst Pfizer described yesterday as a great day for science and for humanity, it was anything but for short sellers who look to have been caught out by the market adjustment.”