A wave of scam text messages are being received across the UK, potentially duping people into giving up their card details in order to claim a non-existent government grant.

The scam has been quickly designed to take advantage of confusion following yesterday’s announcement of another national lockdown due to the coronavirus pandemic.

But there are a number of signals in the text message, including grammar and spelling errors despite claiming to be sent from HM Revenue and Customs, that can alert people to the fraud.

One message seen by Sky News states: “From HMRC: The third lockdown has been announced, we have been issued a grant off £240 to help during this period, visit to claim:” and then links to a website which the criminals control.

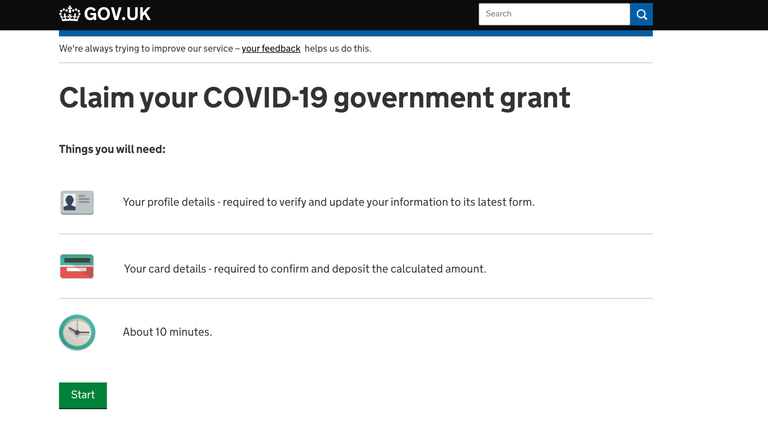

While this website is designed to look like the official government one, it is not hosted on the gov.uk domain, another strong signal that people should use to recognise that the site is illegitimate.

The site also tells users that they will need their card details ready in order to claim their COVID-19 government grant, something which does not exist.

Fortunately both the Chrome and Safari web browsers flag the website as deceptive, and state it may be attempting to trick users into disclosing their credit card details.

A spokesperson for HMRC told Sky News: “Criminals are taking advantage of the package of measures announced by the government to support people and businesses affected by coronavirus.

Scammers text, email or phone taxpayers offering spurious financial support or tax refunds, sometimes threatening them with arrest if they don’t immediately pay fictitious tax owed.

“HMRC has detected 275 COVID-19 related financial scams since March, most by text message. We have asked Internet Service Providers to take down 254 related scam pages,” they added.

“Several of the scams mimic government messages as a way of appearing authentic and unthreatening.

“Over the last year HMRC reported 3,387 phone numbers being used in tax-related phone scams to telecommunication companies for takedown, and responded to over 306,219 reports of phone scams from the public, an increase of 47% on the previous year.”

Warnings regarding a different but similar scam offering COVID-19 tax rebates have also been posted on social media.

These scam texts, which operate in the exact same way – using texts to drive people to a fraudulent website – claim that the potential victim has a pending tax rebate that they need to claim.

Fraud victims lost more than £4.6m to coronavirus-related scams during the first lockdown last March, according to ActionFraud.

As of the end of May, more than 2,000 victims lost cash through fake online goods sales, bogus cold-calls, non-existent pension plans and other frauds.

Another 11,206 people claimed to have been victims of email (phishing) and text (smishing) attempts to trick them into giving out personal details.

The National Cyber Security Centre advises: “Suspicious text messages should be forwarded to 7726. This free-of-charge short code enables your provider to investigate the origin of the text and take action, if found to be malicious.”

HMRC stated: “If someone calls, emails or texts claiming to be from HMRC, saying that you can claim financial help, are due a tax refund or owe tax, or asks for bank details, it might be a scam.

“Check gov.uk for our scams checklist, find out how to report tax scams here, and get information on how to recognise genuine HMRC contact here,” they added.